Where you invest is important, but the amount you invest in each type of investment is also significant. Advisors traditionally recommend a 60/40 investment portfolio. This means that 60% of investments are in stocks and 40% in bonds, or 60% is at higher risk than the other 40%. However, history tells us that this traditional model of investing in stocks and bonds is not as effective as the model that endowments (think Harvard and Yale) use. Over the last 30 years, the average return in the US for someone using the 60/40 model is 8.2%, not bad. But, the Endowment Model Yale earned 13.1% over the same 30 years.

Endowments Like Harvard and Yale

Endowments typically have a large exposure to alternative asset classes. Large endowments usually have most of the portfolio invested outside of public securities (stocks). They don’t need the liquidity and can tie up their money for longer periods of time. Why? The public market does not have as many options as you might think. There are 5,866 individual stocks, with only a subset being the type that most mutual funds/ETFs and investors actually invest in. In the 1990s, that number was around 8,000 companies, hitting a low in 2016 with only 3,500 companies. To put things in perspective, the combinations of mutual funds at any national fund companies are larger than the actual stocks those funds invest in.

Endowments have consistently achieved attractive annual returns with moderate risk. Individuals can do the same by utilizing alternative investments. By using alternative investments, individuals can expose some of their portfolios to similar (and sometimes identical) asset classes as large endowments. In addition, for the part of the portfolio invested in the public stock market, there are now investments that hedge against downside risk instead of holding and hoping the stock increases in value. Most endowments protect the downside of their public equity exposure, and there are investments now on the market that do similar protection for individual investors.

Challenges Associated With Investing Like Endowments

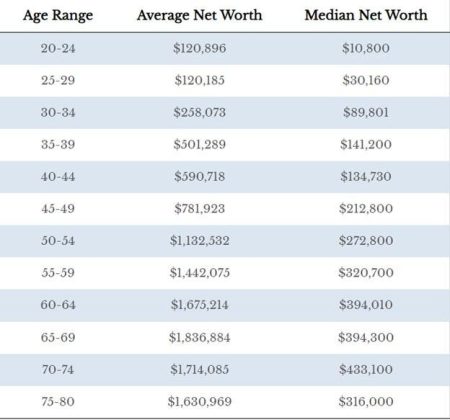

Unfortunately, there are sad truths for investors trying to invest like an endowment would. For the more complicated and most similar to endowments, the investor needs to choose an alternative investment for accredited investors only. To be accredited, investors need $1M of net worth, not counting their home, or $300K of income if married. For many investors, the accreditation is not the hard part; it’s finding the investments. All accredited investments are restricted from advertising, and the entire industry is regulated to not push these products on anyone that is not already a client of a firm that offers these.

Performance

What does adding alternatives to your investment portfolio do to your performance? Over the last 20 years, the top-performing endowments have included more alternative investments. Unfortunately, people aren’t endowments. Even if you qualify as an accredited investor and work with a firm that provides access to these types of investments, you are typically restricted to no more than 10% in these and no more than 25% total invested in these. The rules are to protect investors due to the illiquidity of these investments. Endowments do not have these restrictions. But, increasing the percentage of alternatives in your portfolio is correlated with an increase in return for the same or lower risk. If you qualify as an accredited investor, open your mind (and your 60/40 portfolio) to allocations of alternative investments and be more like an endowment.

Securities offered through Arkadios Capital, LLC (Member FINRA and SIPC).

Past performance does not guarantee or is indicative of future results. This summary of statistics, price, and quotes has been obtained from sources believed to be reliable but is not necessarily complete and cannot be guaranteed. All securities may lose value, may not be insured by any federal agency and are subject to availability and price changes. Market risk is a consideration if sold prior to maturity. Information and opinions herein are for general informational use only and subject to change without notice.

Read the full article here