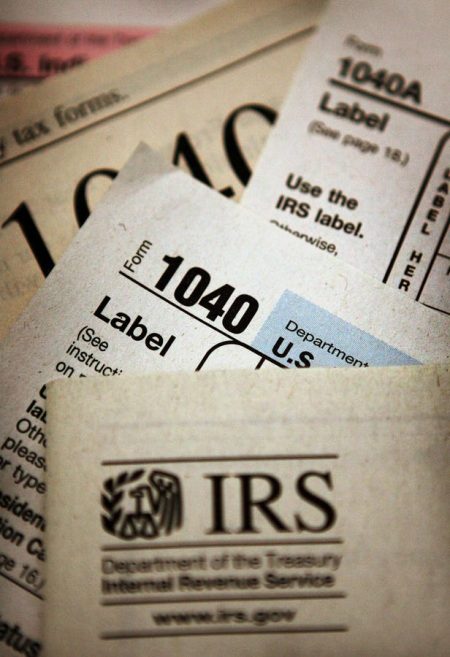

It’s been just over three and a half years since Alex M. Azar II, Secretary of Health and Human Services, declared that Covid-19 constituted a public health emergency. In the months that followed, government officials scrambled to find a way to ease economic shortfalls related to the pandemic through a series of tax breaks, forgivable loans, and other resources. And it didn’t take long after that for criminals to seize the opportunity to engage in tax-related scams and steal funds intended for those who were impacted by Covid-19.

Coordinated Law Enforcement Actions

Since then, the Justice Department and related law enforcement agencies have been working to stop Covid-19 related fraud and punish those responsible. This month, the Justice Department announced the results of a coordinated, nationwide enforcement action to do just that. Those efforts included 718 enforcement actions resulting in federal criminal charges against 371 defendants for offenses related to over $836 million in alleged Covid-19 related fraud.

The three-month coordinated law enforcement action took place from May through July 2023, involving the Covid-19 Fraud Enforcement Strike Forces, the Justice Department’s criminal and civil divisions, and more than a dozen law enforcement and Office of Inspector General (OIG) partners. Of the criminal charges filed against 371 defendants, 119 defendants pleaded guilty or were convicted at trial with over $57 million in court-ordered restitution imposed. More than $10.4 million in judgments were recovered in 117 civil matters. And, prosecutors worked with law enforcement to secure forfeiture of over $231.4 million.

As part of the announcement, Michael C. Galdo, Acting Director of Covid-19 Fraud Enforcement, said that 63 of the defendants had alleged connections to violent crime, including gang members who were accused of using Covid-related funds to pay for a murder for hire. Additionally, twenty-five defendants have alleged ties to transnational crime networks.

Not surprisingly, many of the cases in the enforcement action involve charges related to popular programs like pandemic unemployment insurance benefit fraud and Small Business Administration-related fraud linked to the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). Additional matters also include Employee Retention Credit (ERC) fraud, an issue that’s become so widespread that earlier this year, the IRS included ERC scams on its annual Dirty Dozen list. IRS Criminal Investigations (IRS-CI) has been working with others, including the California Strike Force and the U.S. Attorney’s Office for the District of New Jersey, to bring multimillion-dollar ERC fraud cases during the enforcement action. It has paid off—last month, a tax preparer was recently arrested for allegedly seeking more than $124 million in pandemic-related employment tax credits.

“The Justice Department has now seized over $1.4 billion in COVID-19 relief funds that criminals had stolen and charged over 3,000 defendants with crimes in federal districts across the country,” said Attorney General Merrick B. Garland. “This latest action, involving over 300 defendants and over $830 million in alleged COVID-19 fraud, should send a clear message: the COVID-19 public health emergency may have ended, but the Justice Department’s work to identify and prosecute those who stole pandemic relief funds is far from over.”

New Strike Forces

It appears that they mean it. Deputy Attorney General Lisa O. Monaco announced the launch of two additional Covid-19 Fraud Enforcement Strike Forces: one at the U.S. Attorney’s Office for the District of Colorado and one at the U.S. Attorney’s Office for the District of New Jersey. These two strike forces add to the three strike forces launched in September 2022 in the Eastern and Central Districts of California, the Southern District of Florida, and the District of Maryland.

“The law enforcement actions announced today reflect the Justice Department’s focus – working with our law enforcement partners nationwide – on bringing to justice those who stole from American businesses and families at a time of national emergency,” said Monaco. “The two new Strike Forces launched today will increase our reach as we continue to pursue fraudsters and recover taxpayer funds, no matter how long it takes.”

Tips

The Department of Justice and its partners, including IRS-CI, say they can’t do it alone. They continue to ask taxpayers for tips. Anyone with information about allegations of attempted fraud involving COVID-19 can report it by calling the Justice Department’s National Center for Disaster Fraud (NCDF) Hotline at 866-720-5721 or via the NCDF Web Complaint Form at www.justice.gov/disaster-fraud/ncdf-disaster-complaint-form.

Read the full article here