FIRST ON FOX: A new survey from BlackRock finds that almost two-thirds of Americans like the idea of “Trump accounts” — savings plans giving every newborn $1,000 at birth, with parents and employers able to contribute more and funds growing through stock market investments.

The enthusiasm for the savings program comes as millions of Americans struggle to set aside money for the future. One in three lack any retirement savings and 30% are unable to immediately cover an unexpected $500 bill.

THESE RETIREMENT HOT SPOTS ARE THE PRICIEST IN AMERICA

Even as they near or enter retirement, many Americans have saved less than $150,000 — including a majority of those over the age of 65.

At the same time, a majority of Americans see trade school or college as the best use of funds from a “Trump account.” The least popular uses were buying a car and starting a business.

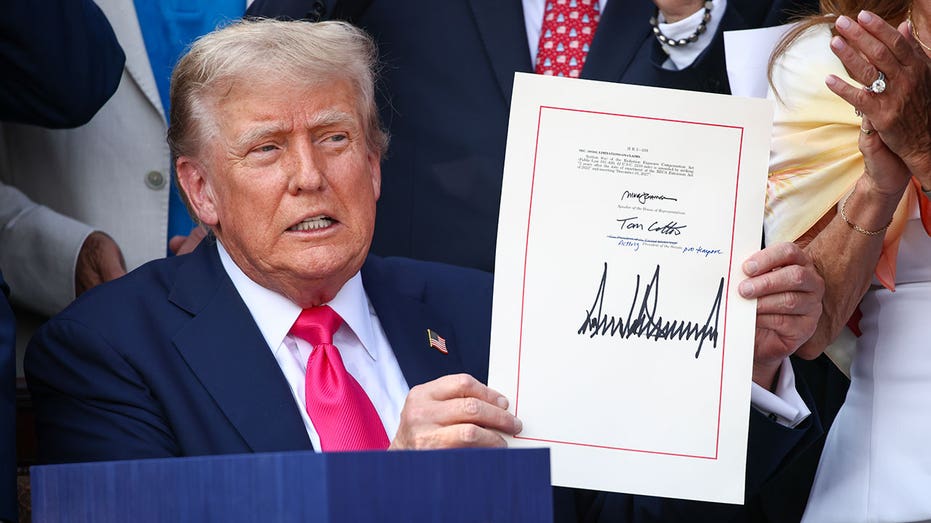

The new savings program, which was tucked into the One Big Beautiful Bill Act and signed into law by President Donald Trump on July 4, offers children an initial one-time $1,000 government investment at birth.

HOW THE ‘BIG, BEAUTIFUL BILL’ GIVES AMERICAN BABIES A FINANCIAL HEAD START

According to Treasury projections, a maximized “Trump account” could compound into a seven-figure nest egg by adulthood.

Parents and relatives can contribute up to $5,000 annually to a child’s account until the child turns 18, with the cap potentially adjusted for inflation after 2027.

If the maximum contribution is made each year on the child’s birthday through age 17, the account could grow to between $191,500 and $676,400, depending on investment performance.

‘TRUMP ACCOUNTS’ FOR NEWBORNS COULD GROW TO $1.9M, TREASURY SAYS

The financial head start for newborns could grow to as much as $1.9 million by the age of 28 if fully funded and left untouched, according to the Treasury Office of Tax Analysis. Even at the lower end of projected returns, the savings account could still yield nearly $600,000 over the same period.

Even without additional contributions beyond the federal government’s initial $1,000 deposit, the Treasury estimates the account could grow to between $3,000 and $13,800 over 18 years.

Families can open an account and receive a $1,000 government investment for each child born between Jan. 1, 2025 and Dec. 31, 2028.

A Social Security number is required to open the account and funds cannot be withdrawn until the child reaches the age of 18.

Read the full article here