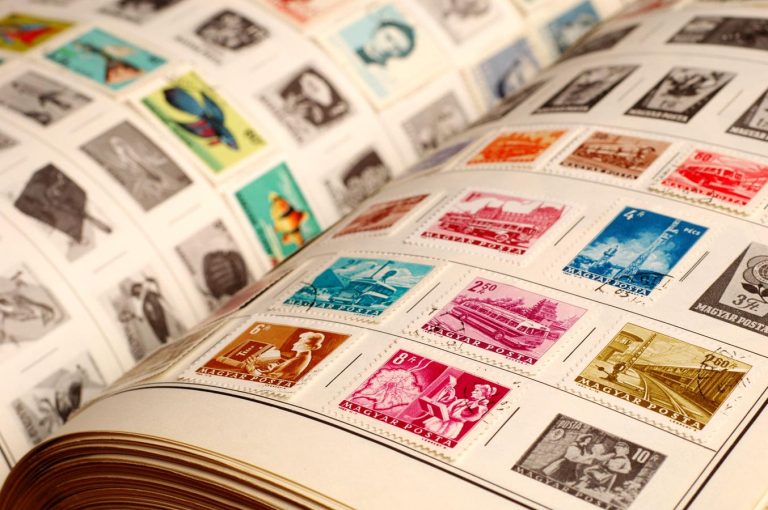

One of the most difficult steps in estate planning is developing a plan to preserve a collection or other special assets.

Serious collectors often put a lot of time, money, and other resources into developing, displaying, and preserving their collections. They’re proud of their collections and derive pleasure from the process as well as from showing the collections to others.

Over time they become concerned about succession planning for the collections. Who will care for and maintain them?

Often, there’s no one among the younger members of their families who both shares their passion and is willing to devote the time and resources needed to take care of the collections, much less expand them.

A collector who wants their passion to become a legacy should consider four steps.

The first step is to create an inventory of the items.

Most collectors know a lot about each item in their possession and rely on their memories. For the collection to become a legacy or have its value maximized, a detailed inventory is necessary. It can be written or digitized.

No detail is too small to include in the inventory. The inventory should include information such as a full description of each item, when it was acquired, the cost, and any history or anecdotes about it.

Next is the valuation and appraisal of each item. Of course, valuations are important for tax planning. But they’re also important for management of the collection.

Executors and heirs often don’t know the value of a collection or the individual items in it. Some have inflated ideas of the worth, while others greatly underestimate what others would pay.

You might need a professional appraiser to assign values. Some collections can be valued using online marketplaces or other sources.

The third step is to be sure the collection’s value is protected. That starts with appropriate insurance against different risks.

But you also need to be sure whoever becomes caretaker knows how to protect the items.

Some items must be stored or maintained in certain environments (temperature, humidity, etc.). Others need to be cleaned or receive certain treatments or maintenance at regular intervals. Be sure you delineate these conditions for others continue.

Finally, create a plan for transferring ownership and care. Often, there’s no one in the family who is able and willing to take over.

There might be a family member or friend who’s interested but would need financial support. In that case, consider if there are ways to transfer both the collection and financial support.

Otherwise, you need to look outside the family. Search for a museum, education institution, or other entity that is interested in acquiring and displaying the collection. You might be able arrange a donation that preserves the legacy and gives you credit.

When there’s no entity willing to accept a bequest on your terms, try to arrange a sale. It’s usually best for the originator of a collection to arrange a sale, because the originator knows best what it is worth and who might be a good successor owner.

There might be one or more collectors willing to purchase all or most of the collection. Or the best strategy might be to arrange a sale of individual items. Determine if this should be done through an auction or by using an online marketplace or similar means to offer individual items for sale.

Building a collection is a lot of work. But when you want the collection to be preserved and be part of your legacy, there’s a lot more work to be done.

Read the full article here