The Supreme Court will hear arguments Wednesday on whether President Donald Trump has the authority to remove Lisa Cook from the Federal Reserve’s Board of Governors, a case with broader implications for the central bank’s independence.

The dispute stems from accusations by Trump administration officials last year that Cook committed mortgage fraud by misrepresenting her primary residence on loan applications.

Trump sought to fire Cook over the allegations, but lower courts have so far blocked the move.

A ruling in the White House’s favor could bolster Trump’s broader effort to exert control over the Fed, including his push to oust Chair Jerome Powell.

TRUMP VS THE FEDERAL RESERVE: HOW THE CLASH REACHED UNCHARTED TERRITORY

At the center of the case is Cook’s lawsuit against Trump, which focuses on a trio of mortgages she took out before joining the nation’s central bank.

The loans, tied to properties in Michigan, Georgia and Massachusetts, have drawn scrutiny over whether she misrepresented how the homes would be used.

Trump seized on those allegations in August as part of his effort to remove her from her post as a Federal Reserve governor, one of the central bankers responsible for steering the nation’s economic policy.

FEDERAL RESERVE GOVERNOR LISA COOK SUES TRUMP

Her lawsuit argues that Trump’s move to fire her is unlawful and undermines the Federal Reserve’s independence. The lawsuit, which was filed in federal court on Aug. 28, does not specifically address the allegations that Cook listed two houses as a primary residence on mortgage filings.

The issue was first raised by Bill Pulte, a Trump appointee who leads the federal agency that regulates Fannie Mae and Freddie Mac. Pulte made two referrals to the Justice Department linking Cook to the three properties.

Primary-residence loans often carry more favorable terms because lenders view them as less risky than mortgages for vacation homes or rental properties.

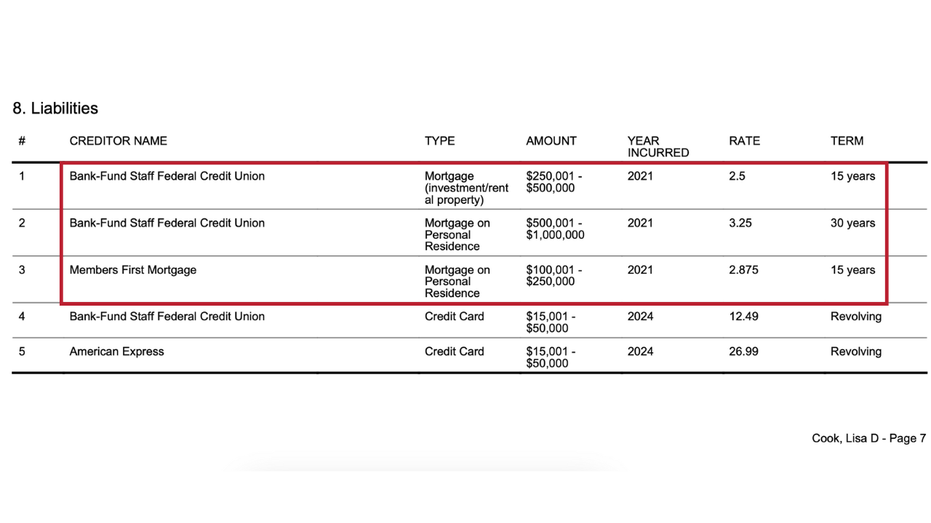

In Cook’s latest financial disclosure report, which is required of federal officials, she lists all three mortgages along with her income, retirement accounts and investments. She electronically signed the report and filed it to the U.S. Office of Government Ethics on June 15, 2025.

The report, which is 12 pages long, shows that Cook earned more than $50,000 a year in rental income from her Cambridge, Massachusetts, condominium. She bought the condo in 2002 when she was a professor at Harvard University. For this property, she obtained a 15-year loan for $361,000 at a rate of 2.5% in April 2021.

Two months later, Cook obtained a $203,000, 15-year mortgage at a 2.87% rate through the University of Michigan Credit Union for a three-bedroom home in Ann Arbor.

At the time, she taught economics and international relations at Michigan State University, roughly an hour’s drive away.

Cook also obtained a $540,000, 30-year mortgage for a luxury condo above the Four Seasons hotel in Atlanta, Georgia.

The loan, issued by the Bank Fund Staff Federal Credit Union, carried a 3.25% interest rate.

In that loan agreement, Cook “affirmed that this property would serve as her primary residence within 60 days of the execution of the mortgage and would serve as her primary residence for a full year,” according to Pulte’s referral letter to the Justice Department.

The Supreme Court has not indicated when it will rule, but it typically issues its decisions by late June or early July.

Read the full article here