Key Takeaways

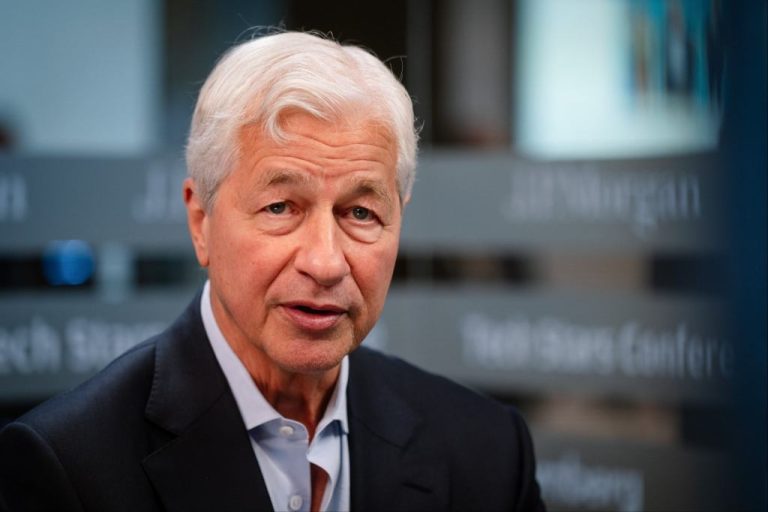

- Jamie Dimon is the CEO of JPMorgan Chase, the largest bank in the U.S.

- In a new interview, Dimon said that JPMorgan is saving billions due to its investment in AI.

- AI has provided “about $2 billion of benefit” to the bank, according to Dimon.

JPMorgan Chase, the biggest bank in the U.S. with $3.46 trillion in assets, invests about $2 billion a year into AI technology. According to CEO Jamie Dimon, that investment has already paid for itself.

Dimon told Bloomberg TV on Tuesday that the bank has saved roughly “$2 billion” every year from using AI in everything from risk management to customer service, and that AI is now helping with operations in nearly every part of the bank, from marketing to idea generation. About 150,000 employees a week use JPMorgan’s internal AI model, trained on the bank’s data, to conduct research, summarize reports and scan contracts, he said.

“We have shown that for $2 billion of expense, we have about $2 billion of benefit,” Dimon told the outlet. “Some we can do in real detail: We did this, we reduced headcount, we saved this time and money. Some you can’t: It just improved service.”

Related: Here’s How the CEO of the Biggest Bank in the U.S. Spends His Downtime: ‘This Gives Me Purpose in Life’

Dimon claimed that the $2 billion worth of cost savings was just “the tip of the iceberg.” He said the bank already has hundreds of use cases for the technology, including fraud detection and risk management, and that number is set to grow. One use case is a cash flow intelligence AI tool that cut human-oriented manual work by close to 90% last year.

However, Dimon also cautioned that AI carries the potential to eliminate some jobs, adding that the bank is focused on “retraining” and “redeploying” employees.

“For JPMorgan, if we’re successful, we’ll have more jobs — but there will probably be [fewer] jobs in certain functions,” he told Bloomberg TV.

Dimon also mentioned that JPMorgan has a long history with AI — the bank has been using and developing the technology since 2012. Currently, it employs around 2,000 AI and machine learning experts.

Related: JPMorgan CEO Jamie Dimon Just Made a Big Announcement About His Retirement Timeline: ‘I Love What I Do’

Dimon has previously weighed in on AI’s impact on humanity, predicting in October 2023 and a year later that the next generation will “live to 100” and “be working three-and-a-half days a week” thanks to the technology. He said AI is the next wave of technological progress, like the steam engine or the Internet.

Meanwhile, JPMorgan’s business is performing well. The bank’s most recent earnings report for the second quarter of the year was “strong,” Dimon stated in a July earnings press release, reporting a net income of $15 billion. The next earnings report date for the bank is Oct. 14.

Related: JPMorgan Chase CEO Jamie Dimon Shares Four Tips for Leaders

Key Takeaways

- Jamie Dimon is the CEO of JPMorgan Chase, the largest bank in the U.S.

- In a new interview, Dimon said that JPMorgan is saving billions due to its investment in AI.

- AI has provided “about $2 billion of benefit” to the bank, according to Dimon.

JPMorgan Chase, the biggest bank in the U.S. with $3.46 trillion in assets, invests about $2 billion a year into AI technology. According to CEO Jamie Dimon, that investment has already paid for itself.

Dimon told Bloomberg TV on Tuesday that the bank has saved roughly “$2 billion” every year from using AI in everything from risk management to customer service, and that AI is now helping with operations in nearly every part of the bank, from marketing to idea generation. About 150,000 employees a week use JPMorgan’s internal AI model, trained on the bank’s data, to conduct research, summarize reports and scan contracts, he said.

“We have shown that for $2 billion of expense, we have about $2 billion of benefit,” Dimon told the outlet. “Some we can do in real detail: We did this, we reduced headcount, we saved this time and money. Some you can’t: It just improved service.”

The rest of this article is locked.

Join Entrepreneur+ today for access.

Read the full article here