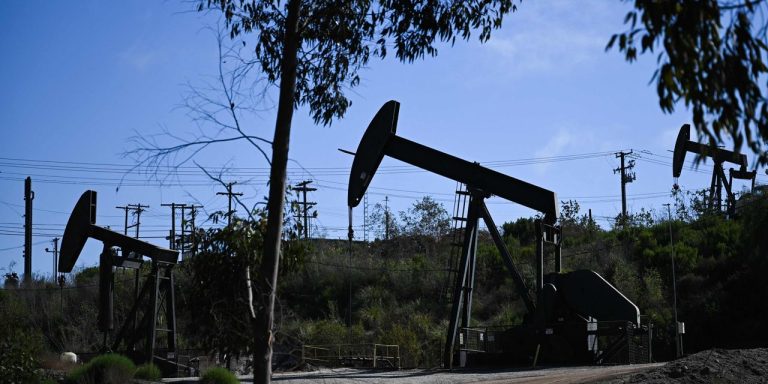

Oil futures settled higher Thursday, snapping a three-day losing streak tied to worries about demand from China, rising Treasury yields and a stronger U.S. dollar.

Price action

-

West Texas Intermediate crude for September delivery

CL00,

+0.09% CL.1,

+0.18% CLU23,

+0.18%

rose $1.01, or 1.3%, to settle at $80.39 a barrel on the New York Mercantile Exchange following a loss of 2% Wednesday. -

October Brent crude

BRN00,

+0.04% BRNV23,

+0.04% ,

the global benchmark, added 67 cents, or 0.8%, at $84.12 a barrel on ICE Futures Europe. -

September gasoline

RBU23,

-0.18%

settled at $2.82 a gallon, down 1.6%, while September heating oil

HOU23,

+0.21%

tacked on 2.4%, to $3.09 a gallon. -

Natural gas for September delivery

NGU32,

added 3 cents, or 1.1%, to settle at $2.62 per million British thermal units.

Market drivers

Crude prices found their footing after pulling back in the wake of a run of seven straight weekly gains which took WTI to a 2023 high last week.

Oil hit fresh 2023 highs last week amid growing confidence among traders that a “soft/no-landing [economic] scenario could be achieved, which was backed up by a rebound in consumer demand metrics within the weekly Energy Information Administration data, said Tyler Richey, co-editor at Sevens Report Research.

Hot U.S. economic data has sent Treasury yields soaring, with the 10-year rate hitting its highest since 2008.

Treasury yields are “pricing in a ‘higher for longer’ Fed policy rate environment which will only further choke off growth, and negatively impact oil demand in the months and quarters ahead,” Richey told MarketWatch.

However, news flow this week has been “less encouraging [for oil] and renewed worries about the Chinese property sector, as well as China’s economy more broadly, has poured some cold water on the economic growth optimism,” he said.

“Underwhelming economic data in the front half of this week, domestically and abroad, further weighed on oil and the refined products,” Richey said. A moderate hawkish shift in Federal Reserve policy expectations has also “bolstered worries that tight policy will choke off growth and send the U.S. economy into a recession, a scenario that would be decidedly negative for oil and refined products from a demand standpoint.”

The U.S. dollar recently rallied, with the ICE U.S. Dollar Index

DXY

rising nearly 1% over the last five days before pulling back Thursday after data showed the leading economic index fell by 0.4% in July, down a 16th month in a row.

A stronger dollar can be a negative for commodities priced in the unit, making them more expensive to users of other currencies.

In order for oil to resume its summer rally and break out to a fresh set of 2023 highs, “we need to see measurable evidence that the Fed is indeed making progress towards pulling off a soft landing and overseas economic data needs to start to stabilize, especially out of China,” Richey said. “Otherwise, last week’s rally may wind up being a false break to the upside and oil prices could retreat back into their familiar 2023 trading range between $67 and $83.”

Meanwhile, natural-gas futures finished higher after the Energy Information Administration on Thursday reported that U.S. supplies of the commodity in storage rose by 35 billion cubic feet for the week ended Aug. 11. That matched the average weekly increase forecast by analysts surveyed by S&P Global Commodity Insights.

Read the full article here