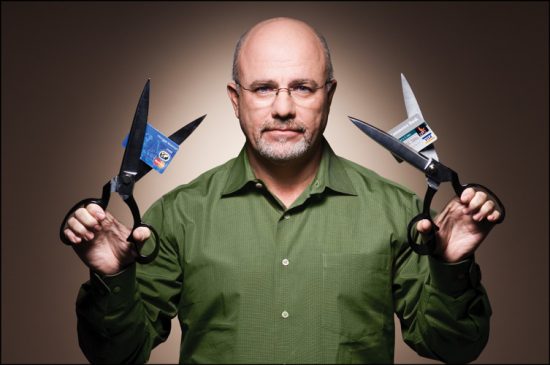

If you’re interested in personal finance, you probably know who Dave Ramsey is. If you don’t know, he’s a television and radio personality (and author) who preaches a “common sense” approach to getting out of debt and creating wealth. His plan is built around seven “Baby Steps” that are designed to lead you to financial freedom. He calls it the “Total Money Makeover.” Dave is a master motivator who is very good at getting people fired up to do something about their finances, and his advice is generally simple enough that most people can understand what he’s saying. Now that the economy is slowing, I see more and more people turning to Dave for help.

However, there is one problem that I’ve noticed with Dave and his system. I’ve known many, many people who have tried his system and failed because they become frustrated, angry and generally unhappy. Why? Because if you really want to follow Dave’s plan the way he teaches it, there is no leeway, no room for individual circumstances to factor in. The Total Money Makeover is a lot like a very restrictive diet that severely limits your choices and leads to rebellion. Yes, some people are successful, but many others fall off the money diet that is the Total Money Makeover.

Dave Ramsey’s Baby Steps

If you read Dave’s books and listen to his programs, he is adamant that you follow his seven Baby Steps in exactly the order that they are written, and you may not move on to the next step until the first is completed. While this makes for an orderly approach and is good for those who crave organization, it can cause some problems. Just to review, the Baby Steps are:

1. $1,000 to start an Emergency Fund

2. Pay off all debt using the Debt Snowball

3. 3 to 6 months of expenses in savings

4. Invest 15% of household income into Roth IRAs and pre-tax retirement

5. College funding for children

6. Pay off home early

7. Build wealth and give. Invest in mutual funds and real estate

According to Dave, until you have all your debt paid off, you shouldn’t be saving for retirement. But this ignores the value that compounding interest brings over time. Even if you’re funneling most of your money to debt payments, any little bit that you can put towards retirement will grow much larger in the future. His idea for a $1,000 emergency fund isn’t bad, but in this day and age $1,000 isn’t going to cover many emergencies. You need a bigger fund than that, but you can’t start building it until all debt is paid off. Until then, if you have a big emergency it’s going to have to go on a credit card, putting you further in the hole.

Is Dave Ramsey’s Advice Too Restrictive?

Why can’t there be a compromise between directing large sums of money to debt, but also putting some in savings and toward retirement? Just like a crash diet is a shortsighted approach to losing weight, Dave’s plan is a shortsighted approach to getting control of your finances. His plan focuses too much on getting the debt down as fast as possible without looking at the larger life that you must also prepare for. Paying down debt is a fine goal, but there are other contingencies you need to prepare for, as well.

Dave’s steps also leave no room for fun or unnecessary purchases. He calls it getting “gazelle intense,” but it’s like telling someone on a diet that they can never have chocolate. Of course, deprivation only makes you want it more and can lead to bingeing when the restrictions become too much. Telling someone that they can’t go on vacation or out to eat once in a while is bound to lead to rebellion eventually. Either that or it may lead to depression, which is just as counterproductive to successful financial management. That’s not to say that you need to go on a swanky resort vacation or to a five star restaurant, but his advice ignores the fact that there are less expensive alternatives that can give you a break from the tedium of debt reduction while not breaking the bank. Just like a diet requires you to give up all “bad” foods, Dave’s plan requires you to put off “living” until you reach step seven, which could take years. It’s important to pay down debt and build for the future, but it’s also important to get some value out of today.

Moderation May Be Better Than Gazelle Intense

His advice also ignores the fact that people have to learn moderation. Just like those who overeat, over spenders have to learn to live in the real world. They have to learn how to spend and save in moderation. Dave’s steps don’t teach people how to live in moderation. You are told from the beginning to simply stop spending, but what happens when you reach step seven and you have built some wealth? Without knowing how to spend moderately, how long do you think it will be before that wealth is gone? His plan does nothing to teach behavior modification. Without that, long term success is iffy at best. As with a dieter, long term success can only be achieved when the causes and triggers of spending are identified and dealt with.

Some people end up feeling like failures on Dave’s plan and give up. Again, look at the dieting analogy. Dieters may be going along great, and then one day they break down and eat a cheeseburger and fries. Then they figure they’ve already screwed up the plan, so why bother to keep trying. This happens to many people who try Dave’s plan. They’re going along great and then they break down and buy a designer handbag (see the rebellion mentioned above). Then they figure that they’ve blown it, so why not get the shoes to match. They resolve to do better tomorrow, but it spirals out of control until they are back where they started. Then they are left feeling like a failure because they couldn’t adhere to this rigid plan and are more reluctant to try again. After all, who wants to feel like a failure? Dave doesn’t teach you how to stop the spiral, deal with the guilt of screwing up, and then get back on track. A more flexible, real-world plan takes into account the fact that we all screw up and shows us how to get back on track.

In what is the great irony of Dave’s model, he frequently advocates that you buy his books, pay to attend his seminars, or pay to join his website. While I understand that the man is a business, he is taking advantage of people’s desperation to get out of debt. Just like diets that promise you that if you buy their food or books or drugs you’ll lose weight, Dave advocates (in a subtle, master marketer’s way) that if you buy his stuff, you’ll lose the debt faster. The simple fact is, with diets or money advice, the more you shell out, the likelier you are to quit when it becomes too expensive. Some people say, “The heck with this. It’s costing too much and I’m not getting anything out of it, so I quit.” Then, not only are they still in a financial or dietary mess, it’s worse because of the extra money spent.

Dave’s Plan Works, But Sometimes You Need To Modify It

Dave teaches some good things, but his plan is too restrictive to be successful for all people. Yes, some people do very well under rigid restrictions and if this is you, I say, “Great!” However, the people that I have known who have succeeded on his plan have taken the basic steps and then modified them to suit their own needs and life situations.

I would encourage you, if you’re interested in trying his plan, that you modify it to suit your own needs and goals. Learn his baby steps, but also know what will enable you to be successful. Tweak the plan until you find a way to work it that works for you. You don’t have to follow him word for word. The Dave police aren’t going to cart you away if you go your own way. You can move up and down the steps as you need to, going back to an earlier one if you fall off the wagon, or jumping ahead if something is more important to you. Without modification of Dave’s plan, you might end up like a frustrated dieter who gives up on the plan because it ends up costing too much and doesn’t take into account the way you really live. Susan Powter, the fitness expert, used to scream, “Modify, Modify, Modify,” during every workout. It’s good advice, both for diets and financial planning.

And don’t spend money for materials. You can find his books for free at the library, his show airs on the Fox Business channel, and there are several free websites that are dedicated to his methods. Some churches offer his classes for free.

Finally, if you aren’t interested scouring the web to get Dave Ramsey’s insight, consider buying a copy of Dave Ramsey’s The Total Money Makeover

. The book is a combination educational guide, inspirational coaching handbook and self study workbook. The book has sold something like 5 million copies – so it is widely read and very popular. Get a copy today.

Read the full article here