Tuesday evening, Fitch Ratings issued an unexpected announcement that the United States’ sovereign credit rating was being downgraded from its top-tier level of AAA to AA+. In its statement, Fitch Ratings rationalized the downgrade as follows:

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

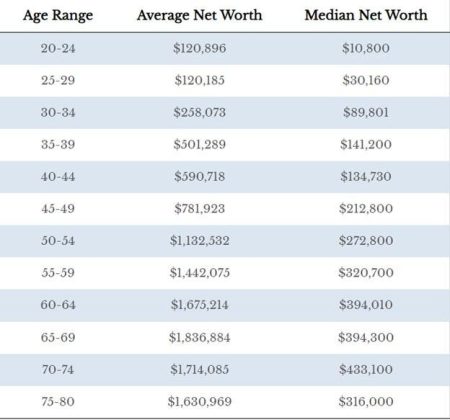

Figure 1. US Debt to GDP Ratio

Dissecting that statement, we can see that Fitch has several reasons for downgrading the US.

- A high debt burden is expected to worsen. As the above chart shows, the ratio of Debt to Gross Domestic Product increased sharply following the last two major crises, the 2008 Financial Crisis and the 2020 COVID Pandemic. While the ratio has improved from near 135% to around 118%, we are still borrowing more than we are producing as a nation.

- The cost of servicing that debt has risen due to the Fed’s aggressive rate hikes. The cost of servicing the US debt has increased by 25% in the last 9 months, through June. Over the next 30 years, the interest costs will total nearly $70 trillion. Although the reaction to the Fitch downgrade was muted, theoretically, a lower credit rating typically demands even higher interest rates as compensation for the risk. With the Fed not yet declaring rate hikes complete and vowing to keep rates “higher for longer”, the borrowing costs will likely remain for several years.

- The proverbial straw that broke the camel’s back in convincing Fitch to downgrade the US was likely the political brinksmanship we saw in the spring during the debt limit standoff. Congress may have learned the meaning of “play stupid games, win stupid prizes” as their debt ceiling theatrics earned the US its second ever ratings downgrade in history. The debt ceiling is an arbitrary number assigned by Congress and could be removed at any time, and in reality, only functions as a tool for political leverage and not an actual constraint on spending. Ideally, Congress would cease toying with the US debt rating and do away with the debt ceiling, but the far more likely outcome is that this will be another campaign rallying point as both sides blame the other for the downgrade.

Equity markets reacted on Wednesday with a modest decline, while the 10-year yield was up slightly above 4%. The actual creditworthiness of the US debt remains unchanged, but in issuing the downgrade, Fitch is simply calling out Congress for its recent bad behavior.

Read the full article here