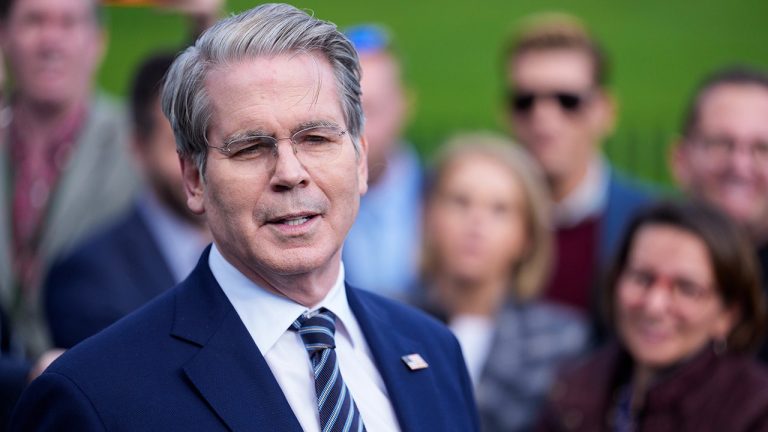

Treasury Secretary Scott Bessent said the U.S. housing market is one subset of the economy that may be in recession because of high interest rates as he continues to call for the Fed to cut rates.

Bessent said in an appearance on CNN that he thinks “we are in good shape, but I think that there are sectors of the economy that are in recession,” adding that “the Fed has caused a lot of distributional problems with their policies.”

The treasury secretary went on to say that “if the Fed brings down mortgage rates, then they can end this housing recession.” Bessent added that lower-income consumers are bearing the brunt of the downturn, in his view, because they have more debt than assets.

The Federal Reserve cut its benchmark federal funds rate last month for the second time this year, though mortgage rates are typically influenced more by long-term bond yields than the short-term rate.

FED CUTS INTEREST RATES FOR SECOND TIME THIS YEAR AMID LABOR MARKET WEAKNESS

Jessica Lautz, deputy chief economist and vice president of research for the National Association of Realtors, told FOX Business, “Lower mortgage rates could help home buyers with housing affordability and small changes in mortgage interest rates in recent months have improved home buyers’ ability to purchase in combination with higher wages.”

“However, the fed funds rate and mortgage interest rates do not move in lockstep,” she added.

Mortgage rates fell for the fourth consecutive week to the lowest level in over a year, with data from Freddie Mac showing the average 30-year fixed mortgage was 6.17%.

NEARLY 1 IN 5 AMERICAN HOMES SLASH PRICES AS BUYERS GAIN UPPER HAND IN SHIFTING MARKET

Lautz noted that home sales have stalled for the last two and a half years at around 4 million existing homes sold annually, whereas the U.S. averaged about 5 million homes sold annually before the COVID-19 pandemic.

She added that “while home sales are stalled, home prices continue to rise” and also noted that homeowners are selling and trading homes less frequently, about once every 11 years, as opposed to the historical average of six to seven years.

INFLATION REMAINED WELL ABOVE THE FED’S TARGET IN SEPTEMBER AHEAD OF RATE CUT DECISION

Lautz also said the housing market is “seeing a tale of two cities” with respect to how high- and low-income consumers are faring in the housing market.

“Homeowners continue to build housing wealth and can make trades using housing equity. While all cash home buyers are seeing all-time highs, first-time home buyers have dropped to a historic low, with the age of first-time buyers now hitting 40,” Lautz said. “The luxury home market is growing as housing wealth and the stock market continue to grow.”

Reuters contributed to this report.

Read the full article here