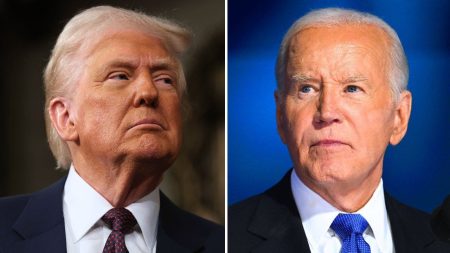

An increasing number of borrowers who filed cases seeking student debt discharge are successfully receiving debt relief through bankruptcy after a policy change by President Joe Biden’s administration, according to the Department of Education.

A total of 588 people filed cases seeking student debt discharged through bankruptcy between October 2023 and March 2024 — a 36% increase from the prior six-month period. Also, a total of 1,220 cases were filed from November 2022 through March of this year. This trend is expected to continue, the Education Department said in a statement.

In filed cases, 96% of all borrowers are voluntarily using the updated guidelines from the Justice and Education departments, announced in November 2022, which includes a standard attestation form that allows borrowers more easily to identify and provide relevant information in support of their discharge request.

Previously, borrowers seeking to file for bankruptcy had to demonstrate they would suffer undue hardship if the debt was not discharged. Now, borrowers must prove they meet three criteria to offload their student loan debt: they lack the ability to repay the loan currently, are unable to repay the loan in the future, and have made a good-faith effort to repay it.

“Our clear, fair, and practical standards are helping struggling borrowers find relief that was previously out of reach,” U.S. Under Secretary of Education James Kvaal said. “This data should puncture the myth that struggling borrowers cannot discharge their student loan debt through bankruptcy. We will continue to work with our partners at the Department of Justice to make it simpler and easier for borrowers to get much-needed relief in the way it was intended.”

MOST HOMEOWNERS WOULD RATHER REMODEL THEIR HOME THAN BUY ANOTHER HOME: STUDY

A recent ruling from the 8th Circuit Court of Appeals effectively entirely blocks the SAVE student loan repayment plan. Education Secretary Miguel Cardona said in a statement that borrowers enrolled in the SAVE Plan will be placed on an interest-free forbearance while the Biden Administration mounts a legal defense of the plan in court.

“Today’s ruling from the 8th Circuit blocking President Biden’s SAVE plan could have devastating consequences for millions of student loan borrowers crushed by unaffordable monthly payments if it remains in effect,” Cardona said. “It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers.”

The Biden Administration introduced the Saving on a Valuable Education (SAVE) plan after the Supreme Court struck down Biden’s student loan forgiveness plan. The White House said that the SAVE plan could lower borrowers’ monthly payments to zero dollars, reduce monthly costs in half and save those who make payments at least $1,000 yearly. Additionally, borrowers with an original balance of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments. The plan now has more than 8 million enrollees.

Initially, only some of the provisions under SAVE – mainly cutting the payments on the loans to 5% of discretionary income from 10% that was set to take effect on July 1st and any new debt cancellations through the program – were stalled as a result of the court-ordered block.

AMERICANS TYPICALLY SPEND ABOUT 24% OF THEIR INCOME ON MORTGAGE PAYMENTS

Only 33% of student loan holders have been making regular payments since they started up again in October – and roughly half aim to use an income-driven repayment plan or are seeking outright forgiveness, according to a Civic Science survey.

Student loan payments picked up again last October after a 42-month payment and interest accrual pause. After a more than three-year pause, many Americans have had to make significant adjustments to their household budgets to afford their student loan payments.

Roughly 58% of student loan holders said that they are at least “somewhat” or “very” concerned about paying their student loans, and more than 60% of borrowers said their student loan debt is impacting their ability to save for retirement. This concern pushes many borrowers to seek ways to suspend loan repayment, even if it means that interest will continue to build on the debt.

“New data reveal a plurality of loan holders have deferred their loans, but 14% report they have one or more loans currently in forbearance, meaning having received a temporary pause on repayment for up to 12 months, while 14% say it’s likely they will apply for forbearance,” the survey said. “Perhaps more concerning, 9% of borrowers have defaulted on their loans, and 6% expect they will go into default. If repayments continue as they have been, the majority of student loan holders will experience forbearance, deferment, or default at some point,” the survey said.

Read the full article here