The 30-year-old Sotheby’s Financial Services, which has mostly helped people finance art transactions, is now turning to classic cars, a move that underscores the booming interest in and the value of certain collectible vehicles.

Classic cars haven’t traditionally been seen as the same kind of established, alternative asset as real estate holdings, jewelry, or valuable art. But as collectible car values have soared, the thinking has begun to change.

“In the last five years, cars have become a legitimate asset category,” says Philip E. Richter, president of Hollow Brook Wealth Management, who is also the founder of the annual Turtle Invitational concours, held in Bedford, N.Y. “People are realizing that a 40-year automobile can be more than just a used car—it can be worth six figures or more.

Certain vehicles have a recognized value that makes them worthy of being lent against by bankers, Richter says.

Andrew Goldberg, a 21-year veteran of J.P. Morgan, where he was global head of market strategy for the private bank, joined Sotheby’s Financial Services, or SFS, as senior vice president and head of collectible cars in May.

“They hired me because I’m a car guy,” says Goldberg, whose focus is lending money to buy high-end vehicles, with US$5 million as the minimum.

“I am helping the world’s most discerning collectors extract economic value from their large collections without having to sell cars,” he says. “There’s an opportunity to manage tax exposure. I can lend up to US$200 million for a single collection, using existing cars as collateral. Nobody else does anything like it, and we’re the only provider able to lend at that scale.”

The decision to offer lending on classic cars was made easier when Sotheby’s acquired a 25% interest in RM Auctions, a large collectible automobile auction house, in 2015, forming RM Sotheby’s. Since then, Sotheby’s has taken a 75% majority position, and the combined entity has maintained a steady stream of collector car auctions around the world. There is obvious synergy for wealthy buyers between collector cars and Sotheby’s other divisions selling art, watches, and wine.

The question is: Why do the wealthy need to borrow money? Goldberg explains that it’s a useful tool. “They borrow to access liquidity for an investment opportunity without having to sell an asset,” he says. They also borrow to “access capital in advance of an auction sale, which can be months away or require months before payments settle.”

As with art, lending against a collectible vehicle unlocks value that otherwise is inaccessible.

This 1999 Mercedes-Benz CLK GTR coupe, estimated at US$8 to US$9 million, is part of a collection of supercars to be auctioned in Las Vegas Nov. 17.

RM Sotheby’s

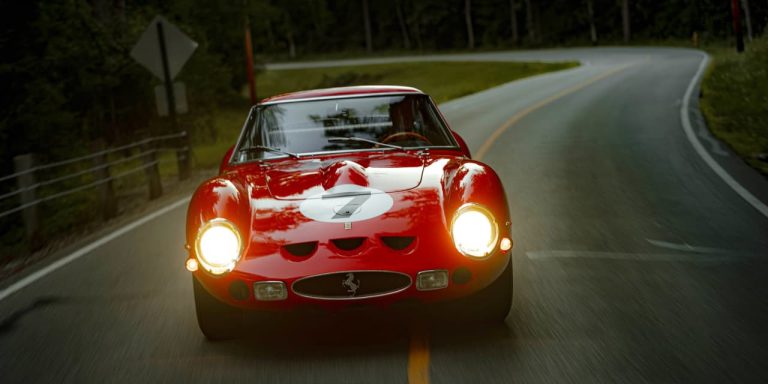

Some classic cars are major acquisitions as values have surged. For instance, a Ferrari GTO is headed to auction on Monday through RM Sotheby’s with an estimated value of at least US$60 million. Through SFS, a borrower could finance half that amount to pay for it or finance the entire purchase price by using other vehicles in a collection as collateral, Goldberg says.

The pool of collectors able to take advantage of what SFS is offering is fairly small, estimated to be about 2,000 people in the U.S., he says.

The practice of lending to collectors is nothing new in the art market. The owner of a US$100 million art collection would have no problem getting some cash by borrowing from banks against the collection to buy a yacht, a vacation house, or other asset, Goldberg says. “But they haven’t lent on cars,” he adds. “Artworks don’t have titles, and to research a car collection you have to research 40 titles to make sure they’re not encumbered.”

Another approach for car lovers to avoid paying cash for a collectible is leasing it, an offering made available by companies like Putnam Leasing, based in Greenwich, Conn.

“There are sales and income tax benefits to a lease over a conventional purchase,” says Rick Intile, national sales manager at Putnam, which was founded in 1983. “We get the consumer approved on income and credit, and then go to banks for the lease. The consumer does not get exposed to credit agencies. We get references from dealers, auction houses, and individuals.”

The lease periods are 13 to 60 months, after which the collector can pay the residual amount and buy the car. If the car has appreciated during the lease term, the surplus goes back to the lessee. Extending the lease is also an option.

Steven Posner, Putnam’s CEO, said in 2020 that a lease allowed buyers to access “a nicer car than you would with direct ownership.” And a lessee can avoid taxes. Posner’s example was a US$1 million 1957 Mercedes-Benz 300SL. “If you buy it, you’ll owe US$90,000 in sales tax up front,” he said.

Other companies that offer leases on exotic and collectible cars include Premier Financial Services, Woodside Credit, and Luxury Lease. Goldberg says SFS doesn’t “compete for that business.”

The global market for collector cars is cooling slightly, though it’s only down from some giddy heights. That might make regular banks less likely to lend on some collector cars, and it creates an opportunity for alternative specialists such as SFS.

Read the full article here