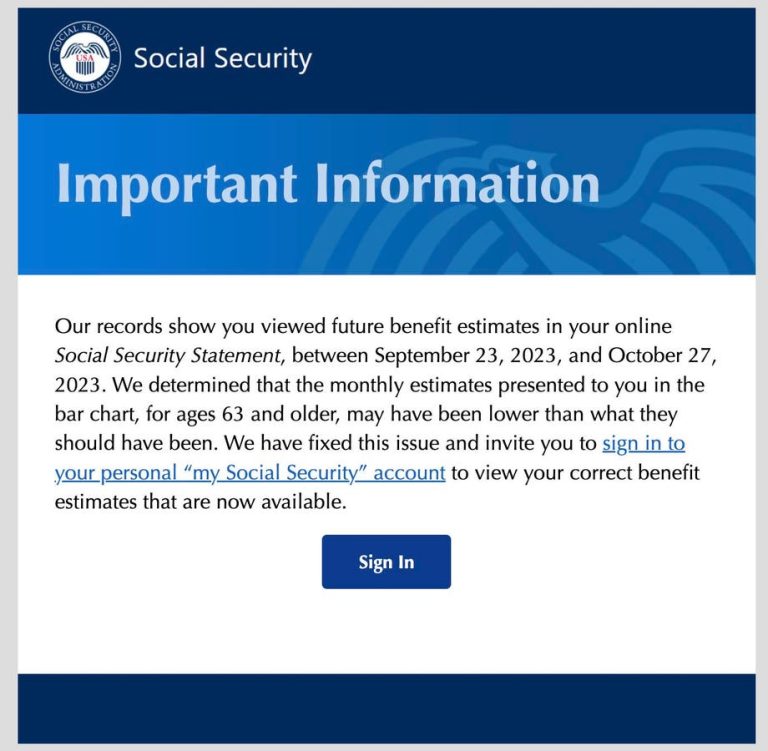

In this October 20th Forbes column, I claimed that Social Security’s website was projecting lower benefits for worker than it had just a few months back. This was confirmed today in an email that Social Security sent to recent visitors.

One of my company’s Maximize My Social Security software users sent me the notice below, which he received today from Social Security. The notice admits it’s been providing mistaken benefit estimates. This is highly troubling on several grounds.

- The mistake was massive. Workers were, in the two cases I discussed, being told their future benefits were up to 17 percent lower than had previously been estimated.

- The mistake apparently wasn’t caught until our client notified me that, unlike Social Security’s software, our software was showing no change, let alone a huge change, in his future benefit.

- Social Security apparently didn’t realize it was providing crazy benefit estimates to, presumably, millions of its website visitors until I notified a senior official at Social Security.

- The mistaken information was disbursed for over more than a month — between September 23rd and October 27th!

- There was no clear reason for anyone to modify the website’s benefit estimator code. Yes, their estimates can be miles off base for those under 60 — because they assume no future economy-wide wage growth, which makes a huge difference to projected future benefit. And, yes, their estimates can be far off base for those under 60 because they assume no future inflation, notwithstanding the very high inflation we’ve just experienced and the significant inflation we continue to experience. And, yes, their estimates can be far off base for those working after age 60 due both to assuming no future inflation and that those working after age 60 continue doing so until full retirement age. But Social Security has chosen to adopt these assumptions forever and hasn’t suggested it was changing them (unless I missed an announcement). So, if there was no reason to change the code, how did the code change to produce bizarre benefit estimates — for an entire month?!!! The answer is either someone internal was fiddling with the code for no good reason or worse — Social Security got externally hacked.

- I suspect a hack, although I have no direct evidence of this. Certainly, Social Security wouldn’t disclose a hack if it did, indeed, arise. Actually, I suspect this is the second hack Social Security has experienced in the last two years. On February 23, 2022, I reported in Forbes that Social Security had sent unknown millions of workers benefits statements that were completely screwed up. The statement emailed to me by a different client, which I copied in my column, specified essentially the same retirement benefit at age 62 as at full retirement age. It also specified a higher benefit for taking benefits several months before full retirement age. Anyone who knows about Social Security’s rules could tell, at a glance, that the benefit statement was nuts. Benefits taken at age 62 are 30 percent lower, in real terms, than those taken at the full retirement age of 67. And they certainly aren’t higher if taken a few months before full retirement. Again, this is the same benefit statement that SSA has been sending out for years. Why would anyone internal have been assigned to “fix” it if it wasn’t broken — hence, my concern that the system is being backed. Interestingly, I believe I was, yet again, the first person to report this to senior Social Security officials.

Here’s the only way I know to get completely correct information about your Social Security benefits:

Don’t Ask Social Security a Single Question. Don’t Read What’s On Social Security’s Website. Don’t Trust their Calculators or Benefit Statements, AND DON

DON

This is harsh, but that’s where I’m at. I’m particularly concerned that no one consults Social Security in light of the fact that Social Security is annually clawing back over 1 million Americans for alleged, but not proven overpayments — i.e., for Social Security miscalculating their benefits.

Social Security Is Clawing Back the Benefits of Almost 1 Million Americans Annually. You Could Be Next!

60 Minutes is running an exposé on the system’s financial abuse this Sunday — November 5th. Here’s a promo. You’ll see, if you watch the episode, Anderson Cooper interviewing famed personal finance journalist, Terry Savage, me, and several clawback victims.

I’ve been writing about what I’ve been calling Social Security horror stories for over a decade. This spring, Terry and I decided to ask people to send us their horror stories. In short order, we collected over 150. And more are arriving daily.

They will all be posted, starting next week, at SocialSecurityHorrorStories.com. You’ll also be able, starting on November 6th, to post your own horror story and get a copy of our new book Social Security Horror Stories — Protect Yourself From the System and Avoid Clawbacks. We’re self-publishing the book on Amazon

AMZN

Terry and I are determined to get Congress to stop Social Security’s abusive practices. Its clawbacks typically run in the tens of thousands of dollars. They typically are demanded decades after the alleged overpayments. They come with no explanation. The appeal process is straight out of Kafka. They can range from $175 to $301,000. Clawback victims can be five years old or 85. Rich or poor, it doesn’t matter. Social Security’s mantra is, in effect,

Our Mistake is Your Mistake and Pay Up or We’ll Stop Your Benefit

Since Terry appears regularly on CBS in Chicago, she was able to contact the producers of 60 Minutes. They immediately realized this is a huge, terrible, and fixable (by Congress) story.

How do clawbacks connect to Social Security’s website miscalculations? The answer is that the system is making benefit-calculation mistakes — indeed, it may be making mistakes about its mistakes — left, right and center. The reasons are laid out in our book as a simple means of protecting yourself from clawbacks and, if you are already collecting, checking that the benefit you’re receiving is actually neither too high or too low, but absolutely correct to the dollar.

Read the full article here