Firm: Pence Wealth Management

Name: Laila Marshall-Pence

Location: Newport Beach, CA

Team Custodied Assets: $1.7 billion

Forbes Rankings: America’s Top RIA Firms, America’s Top Wealth Advisors, Best-In-State Wealth Advisors

Background: At 12-years-old, Laila Marshall-Pence and her mother immigrated to the United States from Egypt after the Six-Day War. In 1980, during her last year of college at the University of California, Los Angeles, a friend of Marshall-Pence’s turned her onto the wealth management business and was her mentor as she got her securities license. “When my first client [in 1980] gave me $20,000 to invest, I never thought anyone would trust me at that age,” she recalls, adding that she learned quickly by attending seminars and talking to other advisors. She eventually met her husband, Dryden Pence III, a retired Colonel and former investment banker who had his own wealth advisory practice at the time. In 2002, they teamed up to form Pence Wealth Management; After years of growing the business, the successful husband and wife team mostly now work with high net worth clients, including a lot of retirees and pre-retirees. “As you get older and have to withdraw money, the planning and distribution stage is much more complex—that’s the area which we specialize in,” says Marshall-Pence.

Competitive Edge: “They call me the tax whisperer,” she says. “It’s not how much money you make but what you get to keep that counts.” While some advisors may prefer to talk about investments, Marshall-Pence and her team painstakingly pore over clients’ tax data and returns. “It’s a more holistic approach to retirement, taxes and estate planning,” she says. Another competitive edge: The firm’s in-house planning and investment teams, which allows them to coordinate the two closely.

Investment Philosophy/Strategy: Marshall-Pence and her husband Dryden describe their investment philosophy as simple: They look for companies with competitive advantages in specific areas of the market. This means identifying “big noble themes” that explain why consumers make purchases and what drives that activity. “We then look for choke points in the supply chain—essentially companies with small monopolies or the ability to make excess margin, which eventually turns into better stock performance,” says Dryden. On the equity side, client portfolios are composed of individual stock investments—predominantly in the U.S., while alternatives are a very small part of a typical portfolio. On the fixed income side, the team favors using ETFs and sometimes individual Treasuries.

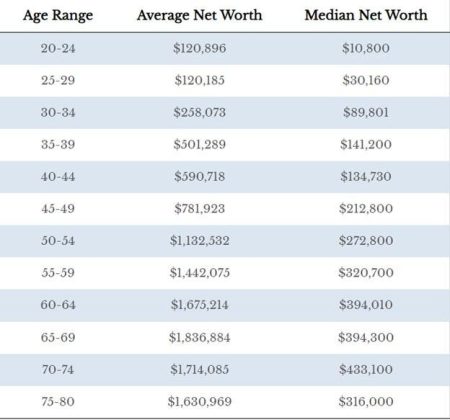

Investment Outlook: Marshall-Pence and her team think that the Fed will keep rates higher for longer, with a reduction in interest rates unlikely until at least near the end of 2024, they predict. Still, they remain bullish on a “broad strengthening of the market” which will continue into next year, especially as unemployment stays low. “It will be mostly a soft landing—investors adapt to whatever interest rates, with people still borrowing and buying real estate,” says Marshall-Pence. “Household net worth isn’t far from record highs and there have been real wage increases in many sectors, which is positive for the economy.” She and her team are positioned for a “resilient U.S. economy that continues to chug along,” with a market that will remain positive as companies see earnings expansion.

Best Advice: It’s important to be proactive about giving clients information from both a planning and investing standpoint, advises Marshall-Pence. Beyond sending out newsletters, she and her husband like to keep clients engaged by regularly hosting a 30-minute podcast in which the two interview each other about topics such as tax and estate planning issues, investments and the Federal Reserve. “It really cuts down on calls with clients… A lot of times because we’re so proactive we often answer their questions ahead of time,” says Marshall-Pence. “It’s a fantastic addition to how we service clients.”

Biggest Challenge: “Getting people to separate the news cycle from their life cycle—there’s a big difference between trading and investing when it comes to markets.”

Favorite Book/Movie/Hobby: An avid sports fan, Marshall-Pence is hoping to visit every football and baseball stadium in the country. She just made it to her 24th football stadium for a recent game in Minnesota and has also been to all four Tennis Grand Slams. “It’s a big release for me and also allows us to see the world and the country,” says Marshall-Pence.

Read the full article here